As I wrote in my blog ‘Home under water’ in June 2013, it is increasingly the case that a residual debt remains after the sale of a home. There is still a lot of uncertainty among homeowners regarding this residual debt. The website www.restschuldinfo.nl has been launched to provide them with correct information on the options open to them despite having a residual debt.

Since Monday 10 February, consumers can consult this interactive website for questions regarding residual debt. The aim of this cooperation between Minister Blok (Housing and Central Government) and the Dutch Banking Association (NVB) is to provide clarity regarding the likelihood of a residual debt in various situations and the possible consequences thereof. Besides general information on residual debt and finance possibilities, the website offers homeowners the possibility of carrying out a ‘situation scan’ by answering up to 10 questions. After this scan, consumers have more insight regarding their personal situation and know what options are available with respect to residual debt. This is very important, since many homeowners incorrectly believe that they cannot move house if there is a residual debt after they sell their home[1]. A possible residual debt does not have to be an obstacle to moving house.

Increase in residual debt

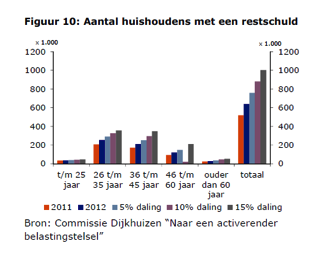

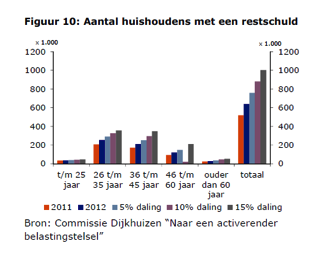

A residual debt exists if the sale price of a home is lower than the mortgage on that home[2]. In this case the house is sold with negative equity. Since house prices fell by 15 to 20 per cent between 2008 and 2012, the difference between the current value of a home and the mortgage debt may be up to tens of thousands of euros. Not only the average amount of residual debt is rising, but the number of households in a situation of negative equity is also increasing[3].

A residual debt, what then?

Let us assume that when you bought your home you took out a mortgage for € 300,000. Now, the value of the property is € 270,000. This means that selling your home will lead to a residual debt of € 30,000. As the former owner of the property, you are of course obliged to repay this debt. Does this mean you cannot purchase a new home? As a financial adviser, I can assure you that there are sufficient options in most situations to purchase a new home, even if you have a residual debt.

In the most ideal situation, you will repay all or part of your residual debt with your own money. The advantage of this is that your monthly expenses will decline. You can also use a gift construction to pay off the residual debt. Until 1 January 2015, parents are allowed to give children a gift of up to € 100,000 for the repayment of a residual debt. Most banks want the debt to be repaid within 10 years. This is also the maximum period in which the interest on a residual debt is tax-deductible.

Financing residual debt

If you are not able to pay off the residual debt on your own, your current bank can undertake to fund this residual debt together with the purchase of a new home[4]. With this residual debt finance, the mortgage covers the residual debt created by the sale of your former home as well as the purchase of your new home. Every lender uses specific conditions for eligibility for this residual debt finance that among other things are based on income and the amount of the residual debt.

The website Restschuldinfo.nl is now available to consumers for general information and frequently asked questions about residual debt. If you are considering taking out residual debt finance or have more specific questions, it is a good idea to contact a financial adviser. I will be pleased to help you to quantify both your risks and your opportunities in this respect.

If you are interested to know your options, Call us on 020 - 575 33 20 or send an e-mail to

info@kredieter.nlRonald Bieger FFPEdited by Sabine Meekel

[1] ING Intermediair Nieuwsbrief dated 10 February 2014

[2] Restschuldinfo.nl

[3] Blog 'Huis onder water' by Ronald Bieger FFP on Vooruitkijken.nl

[4] ABN Amro Intermediaire Verkoop Nieuwsbrief dated 18 February 2014

Within 24 hours

Within 24 hours Specialist

Specialist 100% independent

100% independent Within 24 hours

Within 24 hours Specialist

Specialist 100% independent

100% independent A residual debt exists if the sale price of a home is lower than the mortgage on that home[2]. In this case the house is sold with negative equity. Since house prices fell by 15 to 20 per cent between 2008 and 2012, the difference between the current value of a home and the mortgage debt may be up to tens of thousands of euros. Not only the average amount of residual debt is rising, but the number of households in a situation of negative equity is also increasing[3].

A residual debt exists if the sale price of a home is lower than the mortgage on that home[2]. In this case the house is sold with negative equity. Since house prices fell by 15 to 20 per cent between 2008 and 2012, the difference between the current value of a home and the mortgage debt may be up to tens of thousands of euros. Not only the average amount of residual debt is rising, but the number of households in a situation of negative equity is also increasing[3]. Within 24 hours

Within 24 hours Specialist

Specialist 100% independent

100% independent